How to File for SSDI and SSI Benefits

Many people contact our office when they need to file for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). For the most part, they're intimidated—they probably haven't filed before, and they have no idea how to apply. Accordingly, for people who retain our attorneys, we file applications on their behalf.

But you might not want to hire an attorney, or might not even have the option. Many law firms don't accept clients until after they've received an initial denial. Under section 206(a) of the Social Security Act, Social Security disability attorneys are only paid from "past-due benefits," what most people call "back pay." If you're lucky enough to get a quick approval, then your attorney might make a very small amount or nothing at all.

For people who want to file on their own, we wanted to share some information and tips. We want to emphasize that a lot of this is simplified. Last year, Rebecca and I taught a seminar primarily on how to file applications: there's a lot to talk about! But when people come to us later in the process, we see a few problems again and again (and again). We hope that this guide can help you avoid some common pitfalls.

Should You Apply for SSDI, SSI, or Both?

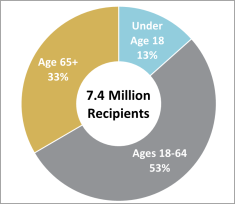

The Social Security Administration administers two major disability programs: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). And it also administers other less common disability programs—depending on whether you count certain programs as unique or as subsets of other programs, almost twenty more disability programs (such as auxiliary benefits, spousal benefits, child's insurance benefits... and so on). And, in an ideal world, you would check all of them to see if you're eligible.

For the most part, though, people are interested in applying for SSDI and SSI.

I cannot emphasize how often we see people who lose hard-earned money when they don't apply for both programs. We even see people who started their claims with other attorneys who filed for SSDI or SSI, but not both, and then the person loses out on thousands of dollars in back pay. It's maddening. Among the people who consult with our office after applying on their own, we conservatively estimate that about 10–15% did not apply for benefits for which they probably would have been entitled. These people generally lose thousands of dollars.

Non-medical eligibility for SSDIis based on your work history and contributions to the Social Security system. To qualify, you must have earned sufficient "work credits," which are acquired by paying payroll taxes. Generally, you need 40 credits to qualify for SSDI, with 20 earned in the 10 years before becoming disabled, although younger workers may qualify with fewer. Unlike SSI, SSDI does not take your financial need or income into account. If you've never had a job—or if you've never paid taxes—you very likely won't qualify for SSDI.

Non-medical eligibility for SSI is based on financial need rather than work history. Among other requirements, individuals must have limited income and countable resources below certain thresholds—generally less than $2,000 for individuals or $3,000 for couples in 2025. Not all income and resources count toward this limit. While SSI eligibility can feel a little complicated to some people, for the most part, you won't qualify for SSI if you have substantial savings.

Again, though, when in doubt: Apply for both programs.

Apply Soon

We also see people who wait too long to file for benefits. If you wait long enough, you won't receive back pay for months during which you were disabled and otherwise would have been eligible for benefits.

For SSDI, you can receive “back pay” forup to one year before your application. This means that if your disability began prior to the date you filed, you may be eligible to receive benefits retroactively—up to 12 months before the application date. So, for example, if you wait three years after your disability began to apply for SSDI, you might lose about two years of benefits.

For SSI, you can receive benefits startingthe month after your application. So, if you wait six months after your disability started to apply for SSI, you will generally lose about six months of SSI benefits.

How to Apply for Social Security Benefits

There are four primary ways to apply for SSDI and SSI benefits.

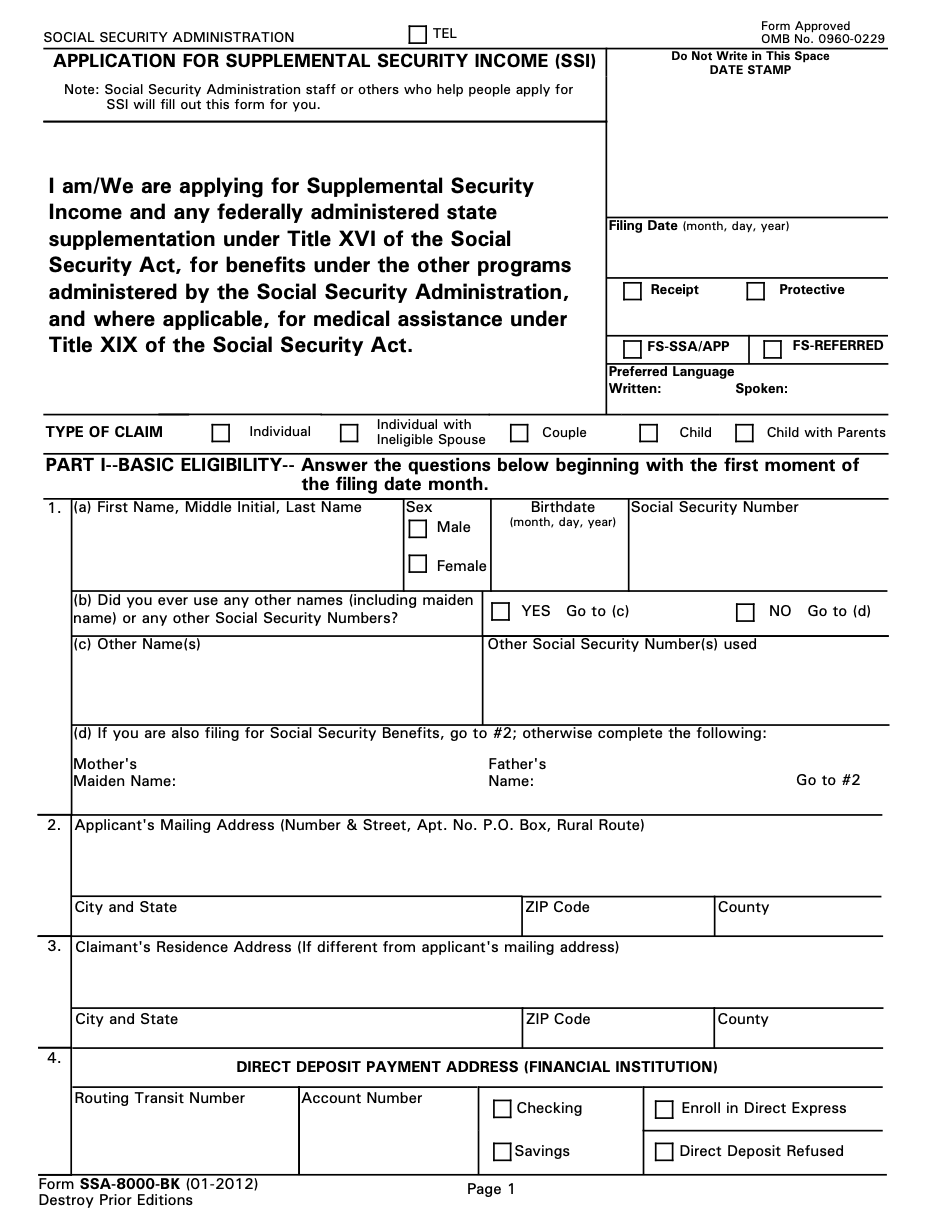

- Application Forms: Complete the SSA-16 (Application for SSDI), SSA-8000-BK (Application for SSI), and supporting documents like the SSA-3368 (Adult Disability Report), SSA-3369 (Work History Report), and SSA-827 (Authorization to Disclose Information).

- Online: Visit SSA.gov to file an application for SSDI. A limited number of people can complete an SSI application online. Other people can indicate interest in applying for SSI online, but the Social Security Administration will need to follow up with you to collect more information.

- By Phone: You can apply by calling SSA, either by calling your local office (which will generally have shorter wait times) or at the national number, (800) 772-1213.

- In Person: Visit your local SSA office to apply. To help with their workflows, most local offices will want you to schedule an appointment.

Consider Your Alleged Onset Date

Provide All the Required Information

Social Security Disability Applications Matter

Disclaimer: The information provided in this blog is for general informational purposes only and does not constitute legal advice. Reading this blog does not create an attorney-client relationship. For advice specific to your situation, please contact Donoff & Lutz, LLC directly to speak with an attorney.